A VCs lifeline - Continuation Funds

In Venture Capital, the path from investment to exit is clear. However, recently VCs are forced to explore new strategies to manage their portfolios and return capital to investors.

Traditional VC funds have a simple model: They raise money from LPs, then invest this capital in startups over typically 10-12 years and, as portfolio companies exit through IPOs or acquisitions, distribute the returns back to their LPs, with the goal of returning multiples of the initial investment within the fund's lifetime.

However, in the current market environment, funds are facing hurdles in returning capital to investors. Startups are staying private longer, delaying potential exits. The M&A and IPO markets have slowed considerably, reducing liquidity options. Additionally, there's often a disconnect between what VCs believe their assets are worth (due to inflated valuations during funding stages) and what buyers are willing to pay.

Funds are adopting a new strategy to solve these issues by taking a leaf out of the PE playbook, using continuation funds to return capital to old investors and attract new ones.

What’s a Continuation Fund and how does it work?

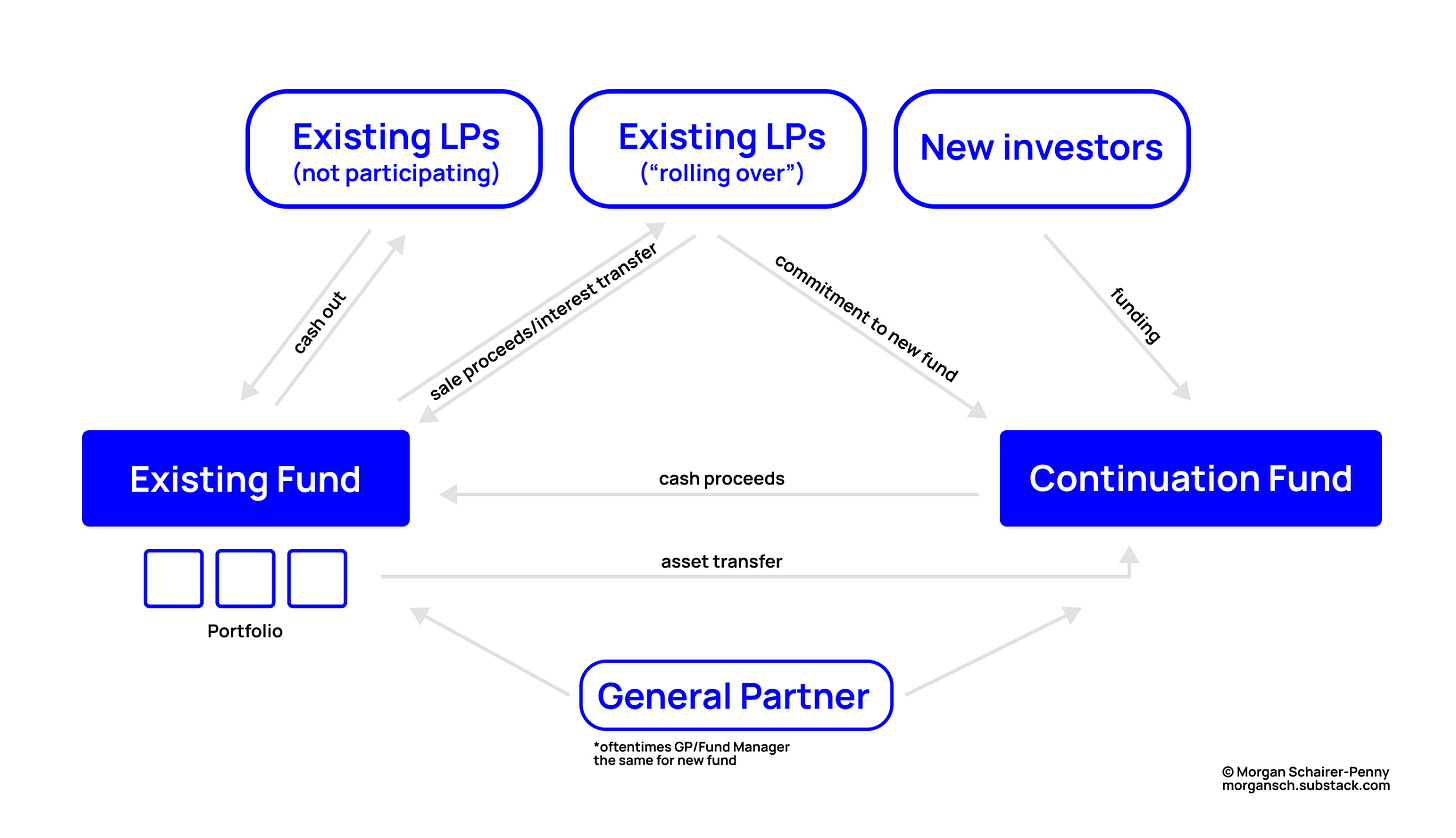

A continuation fund is a new investment vehicle that purchases select assets from an existing VC fund. This process allows the fund manager to extend the holding period for promising companies that may need more time to reach their full potential. The “new” fund manager, who is (typically) the GP of the original fund, identifies a subset of portfolio companies that they believe have significant unrealized value. These are often later-stage companies that are performing well but aren't yet ready for an IPO or acquisition.

Once the assets are selected, a new fund is established, often with a lifespan of 3-5 years. This "continuation fund" is structured to acquire the selected assets from the original fund. Old LPs in the original fund then have a choice:

Sell their stake in the companies to the continuation fund - for immediate liquidity

“Roll over” their existing investment into the new fund - keeping exposure to the assets

(A combination of both options, selling a portion and rolling over the rest)

The continuation fund also needs new investors to provide additional capital. These investors are attracted by the opportunity to buy into more mature companies with proven traction. The price paid by the continuation fund often includes a premium to the last known valuation, to make up the "shortfall" left by nonparticipating LPs and for further value creation, providing some immediate return to selling LPs.

The original fund manager/GP usually continues to manage the assets in the new fund. A new fee and carry structure can be established, often with performance incentives tied to specific milestones or exit values. The continuation fund manager then works towards achieving exits for the portfolio companies within the new fund's lifespan, whether through IPOs, acquisitions, or further secondary transactions.

While still relatively new, continuation funds have been gaining traction. They've been a staple in private equity for a while now, with a median 1.4x multiple on invested capital. This year, Lightspeed Venture Partners worked on a $1 billion continuation fund, NEA and other prominent VCs explored similar vehicles, and Insight Partners closed a $1.3 billion continuation fund in 2023.

Benefits:

Obvious Pro: Continuation funds provide an option for liquidity to LPs who may want or need to cash out their investment, particularly valuable in a market with limited IPOs and acquisitions

These funds can be good deals for new investors, providing access to mature, vetted companies often at attractive valuations relative to their potential

Portfolio companies benefit from not having to deal with newcomers on their cap table, maintaining relationships with investors who already understand their business

New carry & fee structures in continuation funds can realign incentives for fund managers to focus on maximizing returns in the newly extended timeframe

Not always the ideal solution (Cons)

Despite their benefits, continuation funds are not without drawbacks:

Conflicts of Interest - fund managers are on both sides of the transaction - selling assets from one fund to another that they also manage

Keyword “adverse selection” - GPs might use continuation funds to offload underperforming assets to unknowing investors

Determining a fair price for transferring assets can be complex, potentially leading to disagreements and potentially severly underpriced assets

LPs who roll into/join the new fund may face paying new and different management fees or disagree with the new carry structure

This is an interesting broader trend in venture capital. VCs are adopting more complex financial strategies rather than the simple buy and IPO/M&A exit, similar to those used in private equity. The evolution is driven by mounting pressure from LPs demanding returns and the question: is traditional VC a viable and sustainable model?

If you enjoyed this article, consider subscribing to my substack - I’m a economics student in Berlin and write about Startups/VC as often as I can.

Very interesting. Thanks. The various links are also valuable.

Nice one! Never heard about this trend before, but understood it very well after the first read.